Trading Basics (DIY)

Two simple strategies, clear risk rules, and a quick backtesting loop.

Range Trading (5–15m)

- Mark clear support and resistance where price repeatedly bounces.

- Wait for price to reach an extreme of the box.

- Look for a rejection candle or small double-tap, then enter back toward the opposite side.

- Place SL outside the range; target the other side.

Works best in quieter, sideways periods. Avoid during big news.

Range on USDJPY

Risk/Reward (2:1 to 5:1)

Winning isn’t about being right every time — it’s about math.

- At 2:1 RR, a 40% win rate is profitable.

- At 3:1 RR, even ~34% wins can work.

- At 5:1 RR, you can win 1 in 4 and still grow.

Formula: Expected Value = WinRate × RR − (1 − WinRate)

Trend Tap Trading (5–15m)

- Draw a clean trendline that touches at least 2–3 swing points.

- Wait for price to tap the line and print a clear rejection (engulfing/pin).

- Enter with the trend; SL beyond the recent swing; target 2:1–5:1.

- Skip if the trendline is messy or breaks decisively.

Simple and effective — these two (Range & Trend Tap) are among the easiest to learn and apply consistently.

Trade which has a trending line which gets multiple taps

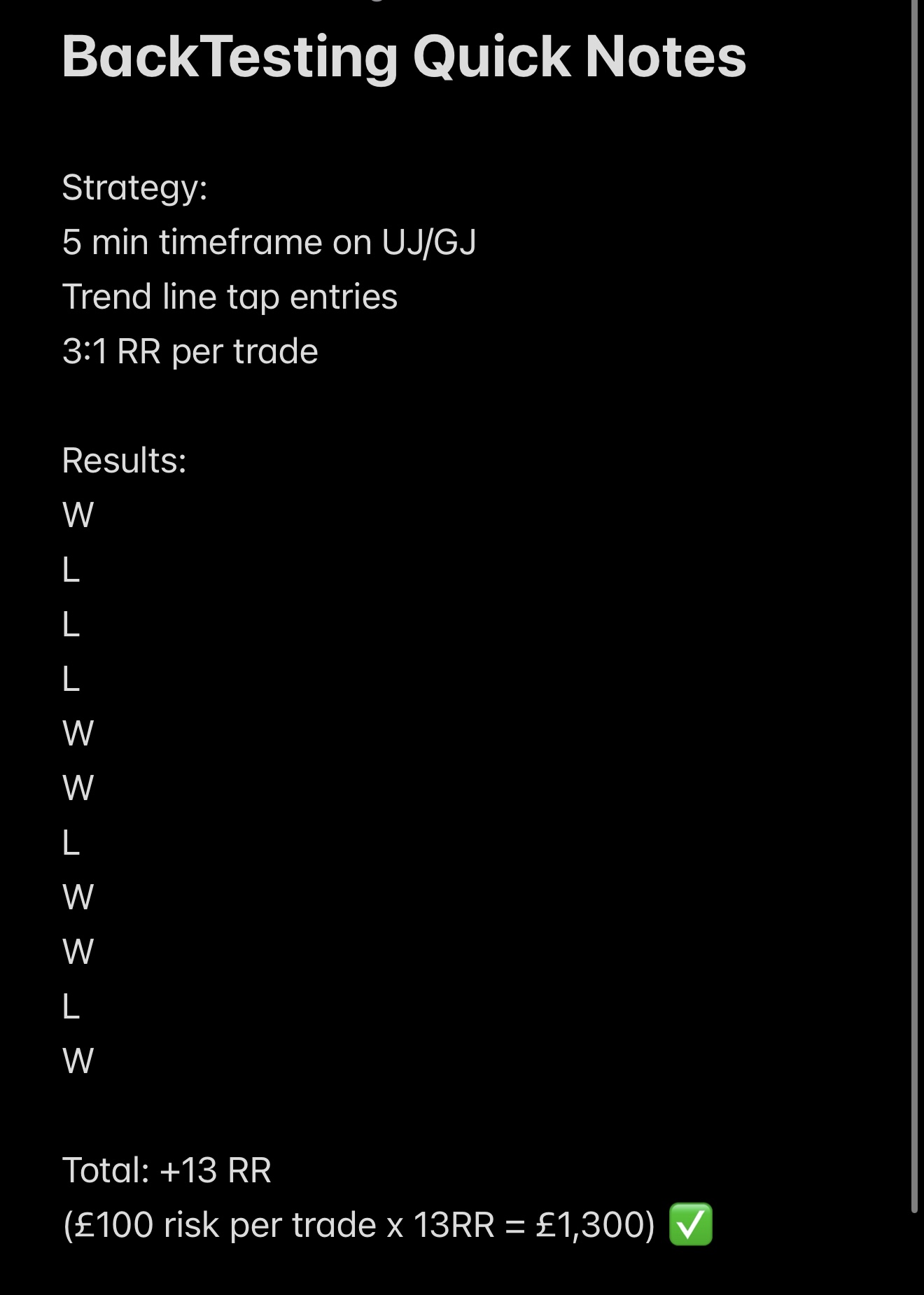

Backtesting (Proof over Opinions)

- Pick one pair and timeframe (e.g. GBPJPY 15m).

- Scroll back, mark every valid setup (no skipping losers).

- Record entry, SL, TP, RR, and outcome.

- Calculate win rate and average RR. Keep the rules that work.

Backtesting puts your strategy to the test. Tradingview allows you to replay the charts

Quick Checklist (Before You Click)

- Clear setup (Range edge or clean Trend Tap)?

- Defined SL beyond structure?

- Target at least 2:1 RR (ideally 3–5:1)?

- Lot size fits your risk plan?

- No major news in the next 15–30 mins?

Trading involves risk. Educational content only.

Want more examples?

Head back to signals or re-read MT4 basics.